Management Consulting

SMA Management Consulting Solutions

Our Management Consulting solutions help you strengthen strategy, boost competitiveness, and drive innovation across your organization.

- We support your success with market analysis, capability development, and Price-to-Win strategies tailored to your goals.

- Our senior advisors offer strategic expertise on your customers, competitors, stakeholders, and evolving technologies.

- You gain access to skilled consultants, proven frameworks, and advanced tools for smarter decision-making.

- We turn complex data into clear insights using tested methods and strategic analytics.

- By working closely with your team, we share expertise and develop targeted solutions that drive measurable outcomes.

Management Consulting Solutions

Innovation

Strategy and capability building using established frameworks to develop a sustainable competitive advantage.

Market Analysis

A validated pipeline based on insights into customer priorities, budgets, and timelines, and competitor capabilities.

Shape™

Understand acquisition strategy now, rather than when you lose.

Competitive Assessment and Price-to-Win (CA/PTW)

Understand your competitive position.

Making Winning Choices™

Efficient development of robust win strategies for dynamic procurements.

International

Insider perspectives on acquisition process and key stakeholders to execute a winning strategy.

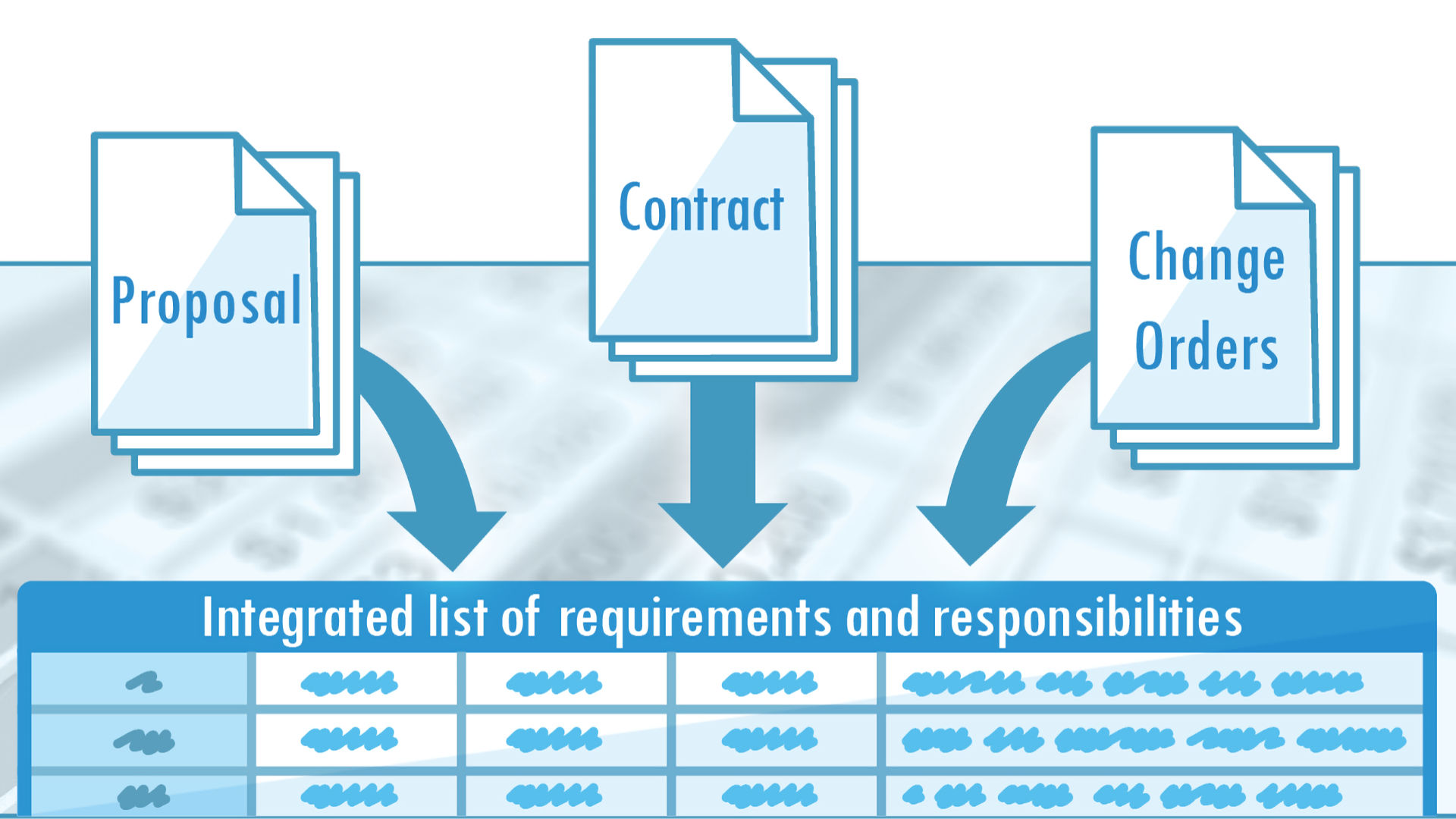

Contract Responsibilities

Detailed analysis of requirements to create a single integrated list of actual responsibilities.

Experts on Demand

Ask us to help you find the perfect government contracting expert for your needs.Improving Sales and Revenue Forecasts in Uncertain Markets: A New Expected Value Approach

Companies rely on their sales pipeline to forecast future new revenues. Even with the use of sophisticated customer management relationship software, most companies continue to struggle with developing accurate forecasts. Revenue forecasting is particularly challenging for companies that are project-based and rapidly growing in their core market, or who are pursuing adjacent or ancillary markets. This book, by SMA President & CEO, Ajay Patel, CF APMP, not only explains why forecasting sales and revenues has been a persistent problem for companies but also gives you the guidance and templates needed to better manage the sales pipeline and more accurately forecast revenues. Click here for more details.Case Studies

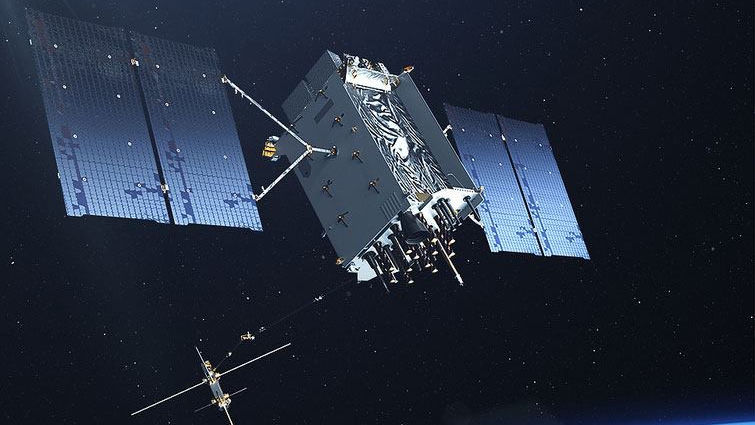

GPS Governance

In an engagement for the DoD CIO and supported by the Deputy Secretary of Defense, we revisited the governance structure for the Global Positioning System. Given the large non-military user base, and diverging needs of commercial and DoD users, we investigated alternate structures to allow a demand-based marketplace to drive future requirements with commercial funding. Study developed alternatives that balanced DoD equities and Congressional funding with new civil capabilities supported by a commercial business model. Findings were briefed to OSD, USAF, DSB and COCOM leaders.

EELV

Based on commercial market impacts on the space launch industry, the Air Force Undersecretary and NRO Director was concerned about DoD’s assured access to space. We were engaged to deconstruct the business models of the two contractors providing launch services to understand the magnitude of investment made, the robustness of their combined DoD and commercial businesses, and scenarios that would impact their ability and desire to continue launching national security satellites for DoD/NRO. The analysis assisted USecAF/DNRO in his negotiations with the two contractors, and precipitated the formation of the United Launch Alliance joint venture as a stable launch services provider to ensure assured access to space.

Organizational Redesign

An $8B business unit of a major defense contractor needed to improve its efficiency and effectiveness as its business evolved and DoD budgets were projected to flatten. Focusing on overhead costs, we used multiple approaches to assess the organizational structure and activity focus to identify gaps between actual expenditures and where value is created. Recognizing the inherent difficulty in assessing each individual activity, we decomposed overhead spending into “asset classes” to determine where spending was out of line with benchmarks and corporate strategy. Result was a comprehensive set of recommendations around organizational redesign and budget reallocations.